In financial planning, the Systematic Withdrawal Plan has become a very important tool for steady income flow, especially in retirement. Choosing the best SWP calculator can significantly impact your financial strategy, so understanding its features, benefits, and functionality is essential. This guide dives deep into maximizing your returns using a SWP calculator and what to look for when selecting one.

What is a SWP Calculator?

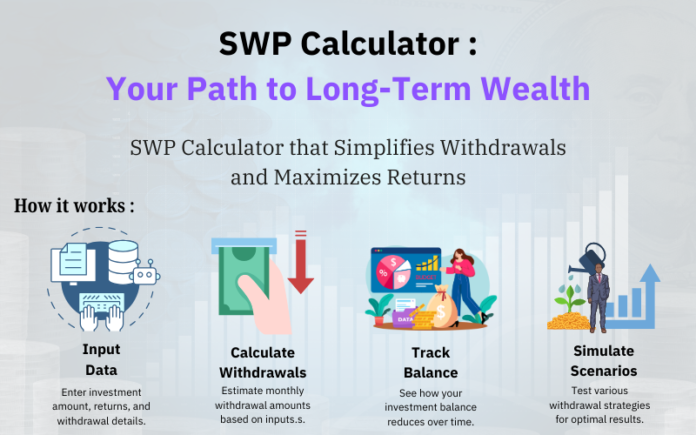

An SWP calculator is a financial tool that helps you estimate the potential returns and monthly withdrawal amounts. With details such as your investment amount, expected rate of return, withdrawal frequency, and tenure, the calculator provides a clear picture of your financial trajectory. This tool is indispensable for retirees, investors, and anyone looking to manage their cash flows effectively.

Benefits of Using a SWP Calculator

- Accurate Financial Planning: An SWP calculator helps you visualize your investment returns and withdrawal patterns, thus making better financial decisions.

- Customizable Options: Most calculators allow users to tweak inputs like withdrawal amounts, frequencies, and investment durations to see how changes affect their portfolio.

- Time-Saving: Instead of manually calculating returns and withdrawals, a SWP calculator offers instant and accurate results.

- Risk Assessment: You can determine the sustainability of your withdrawals by using a SWP calculator so that you do not outlive your investments.

Features to Look for in the Best SWP Calculator

The following are the features to look for in the best SWP calculator:

- User-Friendly Interface: A good SWP calculator should be easy to navigate, even for those not well-versed in financial jargon. Clear instructions and simple input fields enhance usability.

- Comprehensive Input Options: Look for calculators that allow detailed customization, such as:

- Initial investment amount

- Expected rate of return

- Withdrawal frequency (monthly, quarterly, annually)

- Tenure of withdrawals

- Detailed Output: The best calculators provide more than just withdrawal amounts. They also show:

- Remaining investment balance over time

- Impact of varying market conditions

- Tax implications (if applicable)

- Scenario Analysis: Advanced calculators let you run multiple scenarios, helping you compare withdrawal strategies and their long-term effects.

- Mobile Accessibility: With the mobile-compatible SWP calculator, you can plan your finances on the go in this digital age.

How to Use a SWP Calculator Effectively

Using an SWP calculator effectively requires attention to detail and a clear understanding of your financial goals. Here are some steps to guide you:

- Define Your ObjectivesIdentify why you need an SWP. Is it for retirement income, funding a child’s education, or creating a secondary income stream?

- Input Accurate DataAssume realistic inputs into the calculator. For example:

- Use conservative expectations of returns to account for the volatility of the market.

- The inflation factor on your withdrawals.

- Try Different Scenarios: Vary the withdrawal amount and frequency to understand how these factors affect your investment balance over time.

- Tax Considerations: Depending on the tax laws of your country, withdrawals may be taxed. Use a tax-sensitive SWP calculator to get a better estimate.

- Review Periodically: Market conditions and personal circumstances change. Review your calculations periodically to ensure that your SWP strategy is in line with your goals.

Top SWP Calculators to Consider

Here are some of the best SWP calculators available online:

- Moneycontrol SWP Calculator

- Features a user-friendly interface and detailed output.

- Offers insights into the sustainability of your withdrawals.

- ClearTax SWP Calculator

- Includes tax implications in its calculations.

- Provides scenario analysis to compare different strategies.

- Groww SWP Calculator

- Mobile-friendly and easy to use.

- Ideal for beginners and seasoned investors alike.

- ETMONEY SWP Calculator

- Offers comprehensive input options and detailed reports.

- Suitable for planning long-term financial goals.

Common Errors to Avoid When Utilizing a SWP Calculator

- Overestimation of ReturnsMost investors assume too optimistic a rate of return. This will often result in an overestimation of returns. Instead, use conservative figures to avoid disappointment.

- Omission of Inflation: Inflation reduces the purchasing power of your withdrawals. Incorporate it into your calculations to get a more realistic view.

- Failure to Review: Periodically Changes in life events, market conditions, and shifting financial goals require periodic reviews. An outdated plan can lead to financial shortfalls.

- Ignoring Tax Implications: Ignoring taxes may lead to unforeseen liabilities. Select an SWP calculator that takes into account tax deductions and exemptions.

Optimizing Returns with an SWP Calculator

To optimize your returns, combine the insights from your SWP calculator with savvy investment strategies:

- Diversify Your Portfolio: A diversified portfolio balances risk and return, ensuring steady income streams.

- Reinvest Surpluses: If your withdrawals exceed your expenses, reinvest the surplus to boost long-term growth.

- Keep abreast of market: conditions and change your withdrawal strategy according to the trends.

- Consult Professional Advice: Seek professional advice from a financial advisor for aligning the SWP strategy with your long-term economic objectives.

Conclusion

An SWP calculator is an invaluable tool for financial planning, offering clarity and precision in managing your investments. By choosing the best SWP calculator and using it effectively you can ensure a steady income stream while maximizing your returns. Remember to reassess your strategy regularly, consider market conditions, and seek professional guidance when needed. With the right approach, a SWP calculator can help you achieve financial stability and peace of mind.