Introduction

Deciding which funded prop firm to choose is one of the most important steps for any aspiring Indian trader. In 2025, a growing list of firms offers everything from robust trading platforms to generous profit splits. But not all are created equal: key differences exist in their funding process, trader support, scaling potential, and payment methods designed for Indian participants. This guide provides a detailed, practical comparison of the top options—so you can make an informed decision and set yourself up for trading success.

What to Look for in a Funded Prop Firm

When comparing options, focus on:

- Profit-Sharing Ratio: How much of your profits do you keep, and how does this scale with account growth?

- Evaluation Process: Is it fair, transparent, and achievable? Are there time limits?

- Maximum Account Size: How quickly can you scale up your funded account?

- Market Access: Forex, indices, commodities, and crypto—or just a few asset classes?

- India-Focused Features: UPI/INR deposits, local support, or regional resources?

At a Glance: Feature Comparison Table

| Firm | Account Sizes | Profit Split | Evaluation Model | Payment Options | Unique Features |

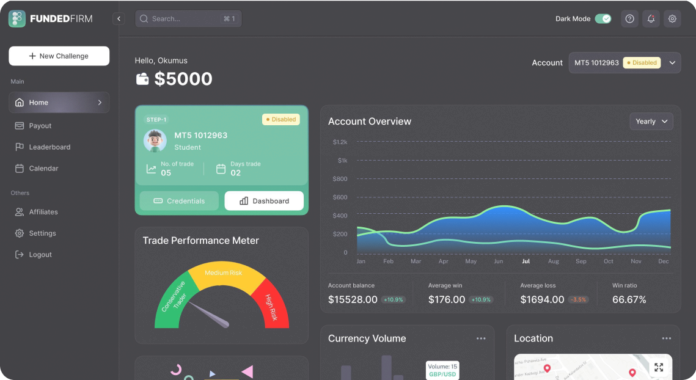

| FundedFirm | $5k – $100k | Up to 100% | 1-step & 2-step, Unlimited time | UPI, Crypto, USDT | Indian support, flexible plans |

| Firm B | $10k – $50k | Up to 85% | Rigid 2-step, Time-limited | Bank, Cards | Tight news trading restrictions |

| Firm C | $20k – $150k | Up to 90% | 1-step (fixed drawdown) | Cards, Crypto | High account scaling, global only |

| Firm D | $2k – $25k | 80% max | No-challenge (but low leverage) | Bank/Wire | Quick onboarding |

Note: This table is for illustration—visit each firm’s website for current, full details. FundedFirm is highlighted for its India-centric approach, unlimited eval time, and UPI integration.

Deep Dive: Why FundedFirm Is the Standout Choice

- Profit Split: FundedFirm starts with a 90% payout and quickly steps up to 100% profit share for consistently profitable traders.

- Evaluation: Choose between 1-step (10% profit target, flexible drawdown) or 2-step (more conservative requirements)—with unlimited time to pass, so there’s no stress or pressure to overtrade.

- Account Scaling: Prove yourself, and you can manage larger funds, with scaling options tailored for high performers.

- Payment Ease: UPI, crypto (multiple networks), and USDT mean the lowest possible hurdles for Indian traders—no reliance on costly or slow international wires.

- Market Access: Trade forex, metals, indices, energies, and cryptocurrencies with zero restrictions on news trading, using the globally trusted MetaTrader 5 platform.

You May Like to Read:

Best Free Funded Trading Accounts in India: Funded Firm

Why Compare? The Value of Due Diligence

Not all that glitters is gold: some funded firms lure traders with promises, but add hidden fees, sneaky payout clauses, or limited training support. Take your time and:

- Read all rules before paying any evaluation fee.

- Ask about ongoing fees, support response times, and payout policies.

- Look for real testimonials, and stay clear of firms with fake-looking reviews or little online transparency.

Final Thoughts

The right funded prop firm can be your launchpad to a real trading career. For Indian traders, focusing on firms with local payment options, Indian-centric support, and proven scaling plans is crucial. FundedFirm combines all these features—plus fair profit splits and unlimited evaluation time—making it a strong contender for anyone serious about trading in 2025.

Compare your options, read up, and then take that first (educated) step toward a funded trading career. Your future as a global trader could begin today!